Real Estate Financial Modelling &

Investment Courses

Real Estate Financial Modelling & Investment Courses

-

Learn from a former Blackstone investor

-

4,000+ students from 120+ countries

-

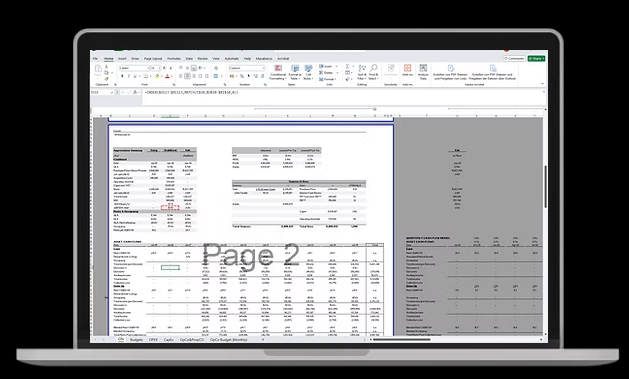

Real-world case studies & Excel models

-

Learn from a former Blackstone investor

-

4,000+ students from 120+ countries

-

Real-world case studies & Excel models

Course Package

6 monthly installments of £64

Prep Handbook

6 monthly installments of £27

Real Estate Investments

6 monthly installments of £18

Estate Valuations

6 monthly installments of £17

Modelling

6 monthly installments of £14

Modelling & Investment

6 monthly installments of £40

Model

Our Mission

Success Stories

Why Us?

A trusted platform to master real estate financial modelling and break into commercial real estate investing

Industry-Proven Results

Alumni work at top PE firms and banks.Top-Tier Instructor

Instructor is ex-Blackstone with 15+ years of experienceGlobal Reach & Reviews

4,000+ students, 100% 5-star reviews.Unbeatable Value

Institutional training at a fraction of the cost.Free Resources

Free Beginner Financial Modelling Course &

Free Real Estate Job Interview Prep Handbook.Free Beginner Financial Modelling Course & Free Real Estate Job Interview Prep Handbook.Hands-On, Practical Case Studies

Real-world workflows, not dry lectures.Learn Anytime, Forever

Learn at your pace, for life.Career-Boosting Certificates

Showcase your skills to employers.

Enrol now for an educational experience that will shape your future in commercial real estate investments.

Start NowCore Curriculum

Real Estate Investment Training

Excel & Financial Modelling Training

Your Instructor

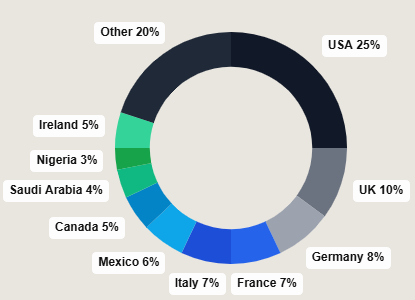

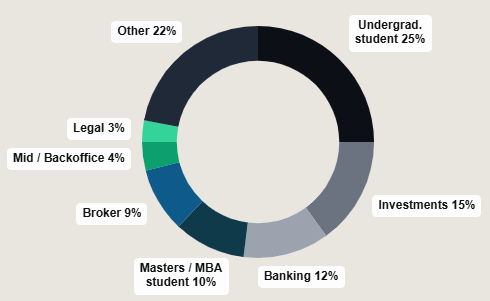

Built for a global audience of

future leaders

community of over

4,000 students

geography

background

Frequently asked questions

REIA courses are taught by a top-tier instructor who is currently the Chief Investment Officer of a private equity-backed real estate investment firm. He began his career at Blackstone, where he mastered how to analyse real estate transactions and build institutional-grade financial models. Students therefore learn directly from an active real estate investment professional how the world’s most prestigious firms underwrite real estate deals.

In addition, REIA courses are affordably priced, highly practical, and built around real-world case studies. They are specifically designed to prepare candidates for real estate private equity interviews, investment banking assessments, and to accelerate the careers of professionals already in the industry.

Yes. After completing each course, students receive a course completion certificate. This can be showcased on CVs, LinkedIn profiles, and job applications, helping you stand out in a competitive real estate job market.

Yes. We offer a free beginner real estate financial modelling course that introduces the fundamentals of investment analysis. This includes downloadable beginner Excel templates and step-by-step lessons. In addition, students can preview selected lessons from our advanced courses before enrolling.

Yes. Every course includes downloadable Excel financial modelling templates, case study files, and supporting materials. You’ll also gain access to industry presentations, market studies, and additional Excel support files to ensure you can replicate professional investment analysis.

Yes. REIA alumni have successfully advanced their careers and secured roles at leading firms such as Blackstone, Starwood, JLL, Hines, Bank of America, Citi, and Morgan Stanley. Our training is highly relevant for students, graduates, and professionals aiming for careers in real estate private equity, investment banking, asset management, and real estate development.

We offer a 72-hour, no-questions-asked refund policy. Simply email us at admin@reia-edu.com within three days of purchase, and your payment will be refunded in full.

All courses are self-paced. Once enrolled, you get lifetime access to the material, which can be revisited anytime. You can also study on-the-go using our mobile app, making it easy to fit learning around your schedule.

Our courses cover a wide range of real estate financial modelling and investment concepts, including DCF (Discounted Cash Flow) and LBO (Leveraged Buyout) models, Real estate valuation, IRR, and cash flow analysis including unlevered and levered returns, market cycles, risk management, and deal structuring.

These are core skills required in real estate private equity, investment banking, and asset management, ensuring our students are fully prepared for professional roles.

Absolutely. Our courses teach universally applicable financial modelling skills and investment concepts used by institutional investors worldwide. Whether you are in the United States, Brazil, India, or Europe, the training reflects global best practices and prepares you for an international career in real estate investment and financial analysis.

Take your financial modelling skills to the next level and accelerate your real estate investing career

Start NowContact Us

Contact us at admin@reia-edu.com